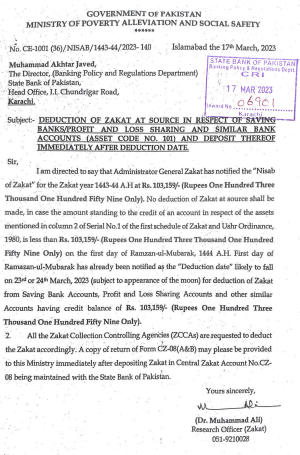

For the ongoing year (2023), the Ministry of Poverty Alleviation has announced the Nisab for the deduction of Zakat. The notification stated that on the first of Ramadan, 2023, the Zakar would be deducted from accounts with a minimum balance of Rs103,159. The notification will be applicable to profit & loss sharing accounts, saving accounts, and other similar accounts. In 2022, the benchmark amount was fixed at Rs88,927.

The statement from the ministry briefed that Zakat would not be debited if the account has a lesser amount than the benchmark set by the ministry. The notice directed all Zakat Collection Agencies to collect Zakat as per the directives.

About Nisab

Nisab is termed as the threshold figure to qualify for paying the Zakat (one of the 05 pillars of Islam). In Pakistan, the notification of Nisab is issued under the Zakat & Ushr Ordinance 1980. The ordinance looks after the collection, disbursement, and provisions related to Zakat and Ushr.