According to the 2001 Income Tax Ordinance, all income is broadly divided into five categories:

- Salary.

- Rent from your property

- The business can generate income.

- Capital gains.

- Income from Other Sources.

Pakistan Income Tax Calculator 2022 –

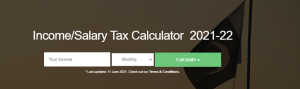

You can check your income tax due with our tool.

Go to the website Income Tax Calculator; https://taxcalculatorpakistan.com/. |

Enter your income/Salary. |

Click to choose whether you would like to enter monthly or annual income. |

Press Calculate. |

The results will be displayed below, along with the applicable taxes, salary after tax, exempt amount, and the tax bracket that you are in.

Income Tax Slabs –

The income tax slabs for FY 2021-22 will deduct a certain amount from the salaries of individuals earning over Rs. 600,000/- per year.

Here are the details about the tax slabs for FY 2021-22.

| Taxable Income | Income Tax Rate in Pakistan |

| Where taxable income exceeds Rs.600, 000 but does not exceed Rs.1, 200,000. | 5% of the amount exceeding Rs.600, 000. |

| Where taxable income exceeds Rs.1, 200,000 but does not exceed Rs.1, 800,000. | Rs.30, 000 plus 10% of the amount exceeding Rs.1, 200,000. |

| Where taxable income exceeds Rs.1, 800,000 but does not exceed Rs.2, 500,000. | Rs.90, 000 plus 15% of the amount exceeding Rs.1, 800,000. |

| Where taxable income exceeds Rs.2, 500,000 but does not exceed Rs.3, 500,000. | Rs.195, 000 plus 17.5% of the amount exceeding Rs.2, 500,000. |

| Where taxable income exceeds Rs.3, 500,000 but does not exceed Rs.5, 000,000. | Rs.370,000 plus 20% of the amount exceeding Rs.3,500,000 |

| Where taxable income exceeds Rs.5, 000,000 but does not exceeds Rs.8, 000,000. | Rs.670, 000 plus 22.5% of the amount exceeding Rs.5, 000,000. |

| Where taxable income exceeds Rs.8, 000,000 but does not exceeds Rs.12, 000,000. | Rs.1, 345,000 plus 25% of the amount exceeding Rs.8, 000,000. |

| Where taxable income exceeds Rs.12, 000,000 but does not exceeds Rs.30, 000,000. | Rs.2, 345,000 plus 27.5% of the amount exceeding Rs.12, 000,000. |

| Where taxable income exceeds Rs.30, 000,000 but does not exceeds Rs.50, 000,000. | Rs.7, 295,000 plus 30% of the amount exceeding Rs.30, 000,000. |

| Where taxable income exceeds Rs.50, 000,000 but does not exceeds Rs.75, 000,000. | Rs.13, 295,000 plus 32.5% of the amount exceeding Rs.50, 000,000. |

| Where taxable income exceeds Rs.75, 000,000. | Rs.21, 420,000 plus 35% of the amount exceeding Rs.75, 000,000. |

Read more Article: How to Check Online Vehicle Tax Calculator 2022 Guidelines